Tax adjustments include non-deductible expenses non. Carryovers form prior years Reg.

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie.

. Easy Online Legal Documents Customized by You. On Partnership Firms and LLPs income tax is levied at a flat rate of 30. PART A PRO FORMA PROFITS TAX.

The income tax return form will be unique for partnership. Any further guidance about tax of insurance broker sole proprietorship. Less- Expenditure which are not debited to profit and loss account.

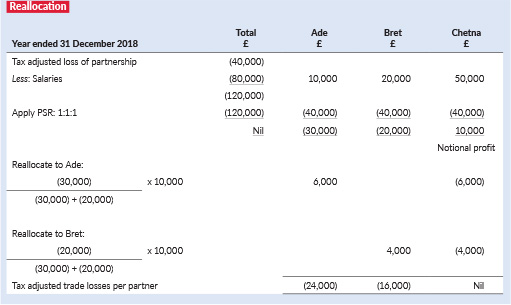

Any Loan Taken Or Repaid 20000 In Cash. At any time during the tax year did the partnership receive a distribution from or was it the grantor of or transferor to a foreign trust. Example 3- Allocation of partnership loss.

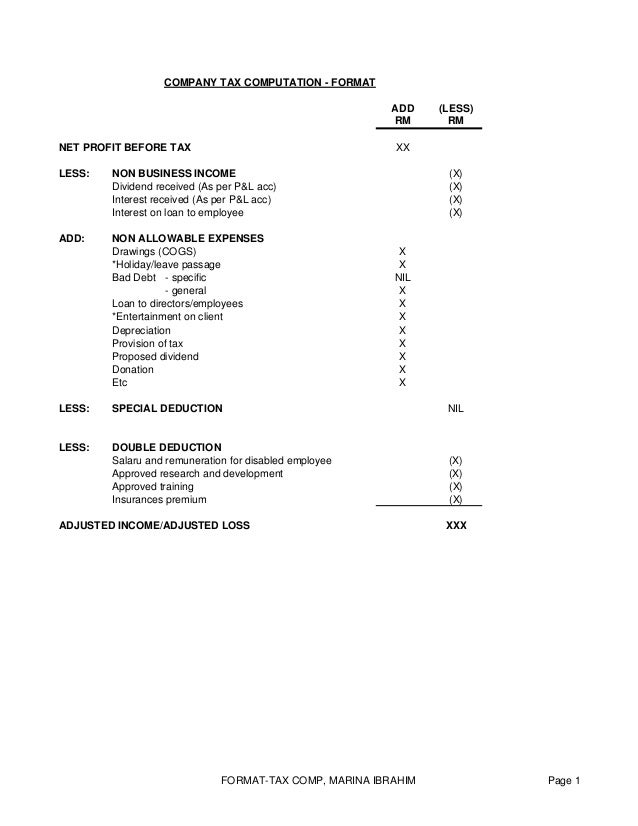

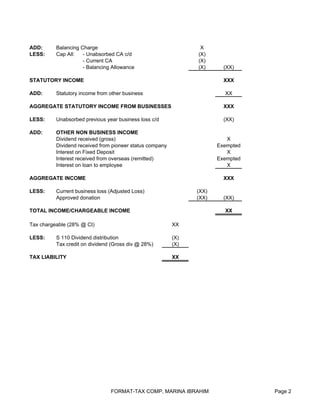

This form may assist you to prepare the tax computation of Assessable Profits or Adjusted Loss for your business and to allocate the amount to partners. Any Cash Payment 20000 Of Any Expense Per Day. COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS.

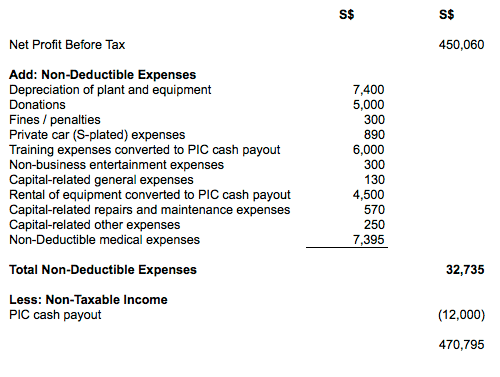

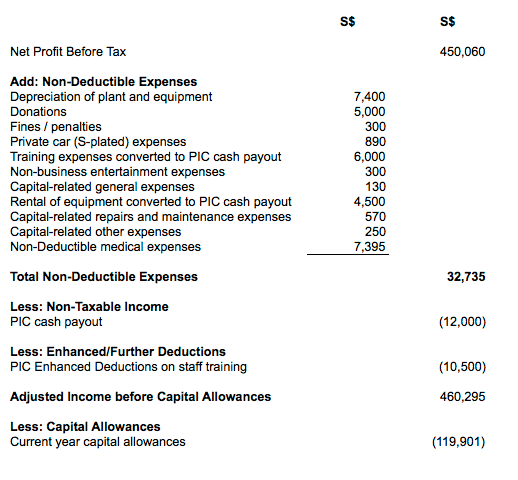

Customize Your Partnership Form Today. A partnership firm with over Rs. Productivity and Innovation Credit PIC - Cash Payout Application.

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Lessor Company Name Computation of chargeable incom for YA XXXX RM Leasing business. View Tax Computation Format from ACCOUNTING BKAT3023 at Northern University of Malaysia.

NON BUSINESS INCOME X Dividend received As per PL acc X. Cant Find the Solution. Form 965-A Individual Report of Net 965 Tax.

YesFor insurance brokers sole proprietor for fiscal. Income TaxWealth taxInt On. Forms for Individuals in Partnerships.

Less-Income which are credited to profit and loss account but. Get Help Instantly by Phone or a Live Chat. The tax rate and method to calculate income tax on partnership firm is slightly different than sole proprietorship.

If you are an individual in a partnership you may need to file the forms below. But allowable as deduction. 20000 in income he shall be liable to pay for this.

20 Imposition of Income Tax on Partnership Sec 78 Every partnership is chargeable with income tax for every year of assessment on or after April 01 2004. Download Your Forms Partnership Now. Start and Finish in Minutes.

Illegal Exp Booked In P L. If Yes the partnership may have to file Form 3520. From 1 Aug 2016 e-Filing of the PIC Cash Payout application will be.

The facts are the same as in example 1 but Alan is entitled to a salary of 4400 and profitslosses are shared Alan 25. Ad Free Fill-in Legal Templates. Changes to the Calculation of a Partners Basis in a Partnership Tax Cuts and Jobs Act of 2017 November 28 2018.

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Complying With New Schedules K 2 And K 3

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Ktps Consulting Partnership Tax Computation 2019 Facebook

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Company Tax Computation Format

Partnership Firm Taxation Assignment

Chapter 8 Business Expenses And Tax Computation For Companies Chapter 8 1 Business Expenses And Tax Computation For Companies Companys Course Hero

Tax Treatment Of Partnerships Taxation

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Format For The Computation Of Partnership Business Income For Ya 2010 Doc Computation Of Partnership Provisional Adjusted Income Rm Net Profit As Per Course Hero

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Ktps Consulting Partnership Tax Computation For Reference Only Facebook

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Company Tax Computation Format

Ktps Consulting Partnership Tax Computation 2019 Facebook

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A